1 Pay income tax via FPX Services. Income Tax Calculator Financial Year 2022-23.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Luxembourg Last reviewed 19 July 2022 42 plus 9 solidarity tax.

. However foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced which is received in Malaysia is no longer be exempted with. The finance ministry on Thursday said the move is to ensure. Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia.

Tax rates range from 0 to. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on income.

Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie. Here are the many ways you can pay for your personal income tax in Malaysia. 10 3 Jehad Tax Liechtenstein Last reviewed 24 June 2022 224.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Under the Act for tax years beginning after 2017 and before January 1 2026 new Section 250 allows as a deduction an amount equal to 375 of a domestic corporations foreign-derived intangible income FDII plus 50 of the GILTI amount included in gross income of the domestic corporation under new Section 951A discussed above. Remember you must ensure the organisation you donate to is approved by LHDN.

An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. For tax years beginning after.

Malaysia Information on Tax Identification Numbers Updated 2 December 2020 Section I. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. There are virtually millions of.

The participating banks are as follows. If in any year the deductions which would have been allowable deductions but for rural development income being exempt income exceed the amount of assessable income referred to in Section 45J1 resulting in a loss the loss shall be deemed to be a loss incurred in deriving assessable income and shall be deductible in accordance with the provisions of Section 101 or. Get FREE real time quotes on our website App.

Let us understand the salary package and the incentives earned by an Income Tax. Section 80JJAA has been made available in the Income Tax Act to. Malaysia Income Tax Brackets and Other Information.

Try MST28 trading from Mercury Securities with rates as low as 005. Purchase of basic supporting equipment for disabled self spouse child or parent. Macau SAR Last reviewed 19 July 2022 12.

Check if the total monthly tax deductions. For more details check out our detail section. Lithuania Last reviewed 11 August 2022 32 see Lithuanias individual tax summary for rates for individual activity income and other non-employment-related income.

Article 41 and Article 1211 of the Federal Constitution of Malaysia 1957 Order 92 Rule 4 of the Rules of Court 2012 Sections 99 103 106 and paragraph 341 Schedule 5 of the Income Tax Act 1967. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

Income tax payers will not be allowed to enrol in the governments social security scheme Atal Pension Yojana APY from October 1. Earn MS Coin when you trade with MST28. While the scope of ASC 740 appears to be self-explanatory the unique characteristics of different tax regimes across the United States and the world can make it difficult to determine whether a particular tax is based on income.

Try MST28 trading from Mercury Securities with rates as low as 005. Charge of income tax 3 A. Non-chargeability to tax in respect of offshore business activity 3 C.

If unsure you can check the status of the charitable organisation on LHDN website. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

First of all you need an Internet banking account with the FPX participating bank. As per the grade you are selected for there can be a mild variation in the salary. Short title and commencement 2.

TF or C etc space Income Tax Number Maximum 10 numeric characters TF. If you have never filed your taxes before on e-Filing income tax Malaysia 2022. Refer to our tax deduction section to understand more about this deduction.

The starting salary of the SSC CGL Income Tax Inspector and Income Tax Officer is somewhere around 44900 INR along with a grade pay that ranges somewhere between 4000-5500 INR. Section 80JJAA of Income Tax Act 1961 provides deduction for the recruitment of new or additional employees. Space Income Tax Number Maximum 11 numeric characters SG 10234567090 or OG 25845632021 Non-Individual File Number Type of File Number 2 alphabets characters.

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Inflation How You Can Beat It Or Even Benefit From It Make More Money Saving Money Investing For Retirement

Taxation Assignment Help Assignment Help Australia Uk Usa Malaysia 9 5 Page On All Writing Assignments Helpful Writing

Business Activity Code For Taxes Fundsnet

Global Tax Management Linkedin

Income Tax Law Changes What Advisors Need To Know

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

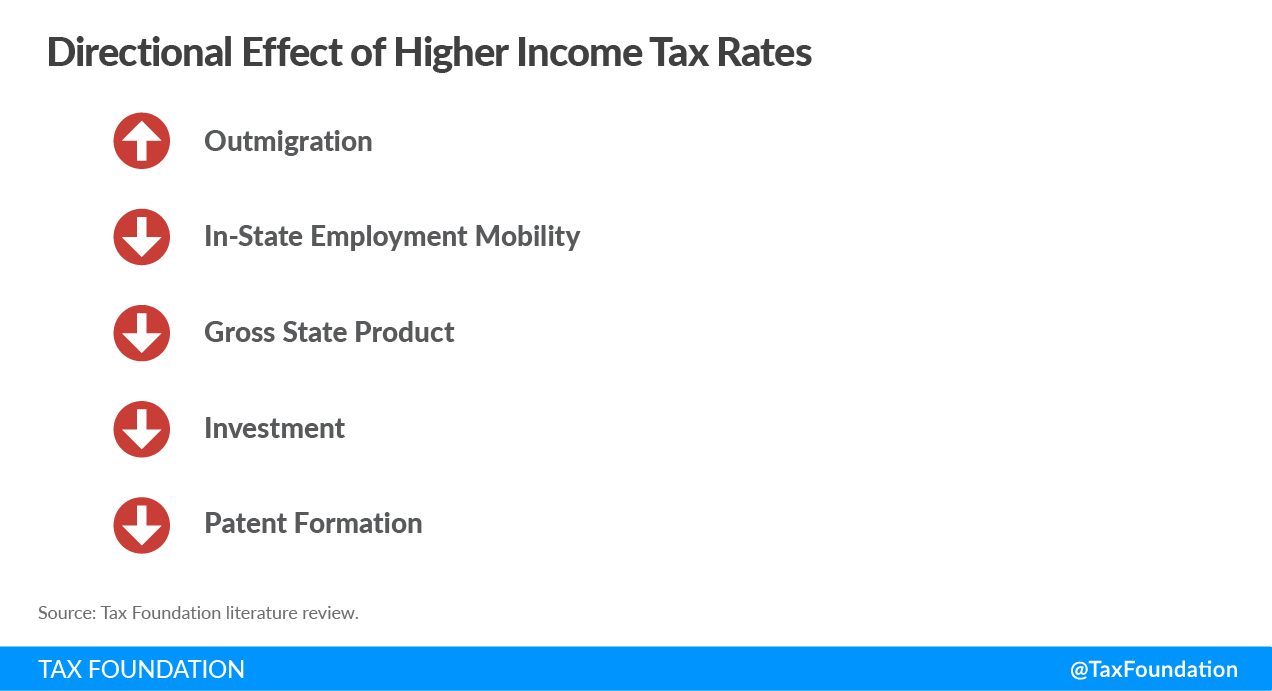

How Do Income Taxes Affect The Economy Tax Foundation

The 13 Latest Tax Refund Scams To Beware Of 2022 Update Aura

Dot Com Dinner At Mastro S Ocean Club Las Vegas Las Vegas Clubs Ocean Club Las Vegas

Us New York Implements New Tax Rates Kpmg Global

International Taxation Books Online International Education

13th Month Pay An Employer S Guide To Monetary Benefits

How To Trade Inside Bar Candlestick Patterns Trading Charts Forex Trading Strategies Videos Forex Trading Quotes